When securing a personal bank loan, there are plenty of different types of lenders to consider, which include banking institutions, credit score unions and finance companies. Of those solutions, Additionally it is intelligent to think about online lending networks.

Credit history unions also ordinarily are inclined to supply smaller loan quantities than banking institutions and online lenders. Navy Federal Credit Union, For illustration, presents loans as little as $250.

CNBC Choose as opposed online house loan lenders according to things including personal loan sorts, down payment demands and nationwide availability. (See our methodology for more information on how we select the finest online home loan lenders.)

Qualifying for reduce APRs needs a potent credit history profile, even though you could possibly often help your credit rating score and reapply at a later on date.

The non-public bank loan application process may perhaps take a little bit for a longer period to finish as compared to online lenders, however , you may well accessibility benefits like no-cost loans. Financial institutions can also require that you simply visit an area department in man or woman as a way to shut on the bank loan.

Even though your individual house isn’t in danger with unsecured loans, you could nevertheless be sued by a personal debt collector in case you tumble powering on payments.

We predict it is crucial to Permit you to know about the revised credit utilization service fees, In order to ensure that we keep on to provide the highest good quality expert services and home listing on our platform are more correct as follows :

When autocomplete final results can be found deplete and down arrows to review and enter to pick out. Touch gadget users, take a look at by touch or with swipe gestures.

Just how much am i able to borrow for an Online Loan? The sum of money you’ll be capable to acquire from an Online Bank loan depends on cash flow qualification conditions plus your credit score heritage, along with state legislation and rules. Click here the link to learn more about mortgage amounts and costs.

Though BHG isn’t totally distinct about its eligibility prerequisites for a personal personal loan, listed here’s what you’ll need to have whenever you implement:

This involves accessing various secure regions of the web site. Devoid of this cookie the website will not perform thoroughly. And it will do the job by default. with out being able to disable Analytics cookies

But this compensation will not impact the information we publish, or the reviews that you simply see on this site. We don't contain the universe of providers or economic presents Which may be available to you.

Financial debt consolidation and charge card refinancing include utilizing a new financial loan to pay off your existing stability. This doesn't reduce debt, but replaces a person debt with A different. Though individual bank loan premiums generally are reduce than credit card curiosity charges, it's possible you'll pay much more in origination charges and curiosity in excess of the life of the bank loan dependant upon other financial loan phrases. Remember to check with a money advisor to find out if refinancing or consolidating is ideal for you.

We are an unbiased, advertising and marketing-supported comparison support. Our aim is that can assist you make smarter fiscal choices by providing you with interactive applications and money calculators, publishing first and objective written content, by enabling you to perform research and Evaluate information without spending a dime - so that you could make monetary selections with self esteem.

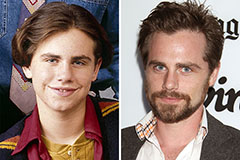

Rider Strong Then & Now!

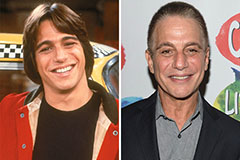

Rider Strong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now!